We transform your business by harnessing the power of AI and digital technology to drive innovation, efficiency, and exponential growth.

From predictive analytics to autonomous decision-making, artificial intelligence (AI) is no longer a distant vision—it's the engine accelerating global transformation. But here’s the truth: AI is just getting started. For investors looking to capture exponential returns, the time to engage is now.

As CEOs across industries recalibrate their strategies for an AI-driven future, this article explores why AI is not a momentary trend, but a seismic shift reshaping the fundamentals of private investing, innovation, and enterprise value creation.

“AI is not another digital tool; it’s the new electricity,” said Andrew Ng, Stanford professor and founder of Google Brain. This analogy rings louder today than ever. According to McKinsey, generative AI could add between $2.6 trillion and $4.4 trillion annually to the global economy across 63 use cases.

Private equity giants like Blackstone and Apollo are accelerating their AI investments. Goldman Sachs predicts AI could drive a 7% increase in global GDP over the next decade—a $7 trillion economic surge.

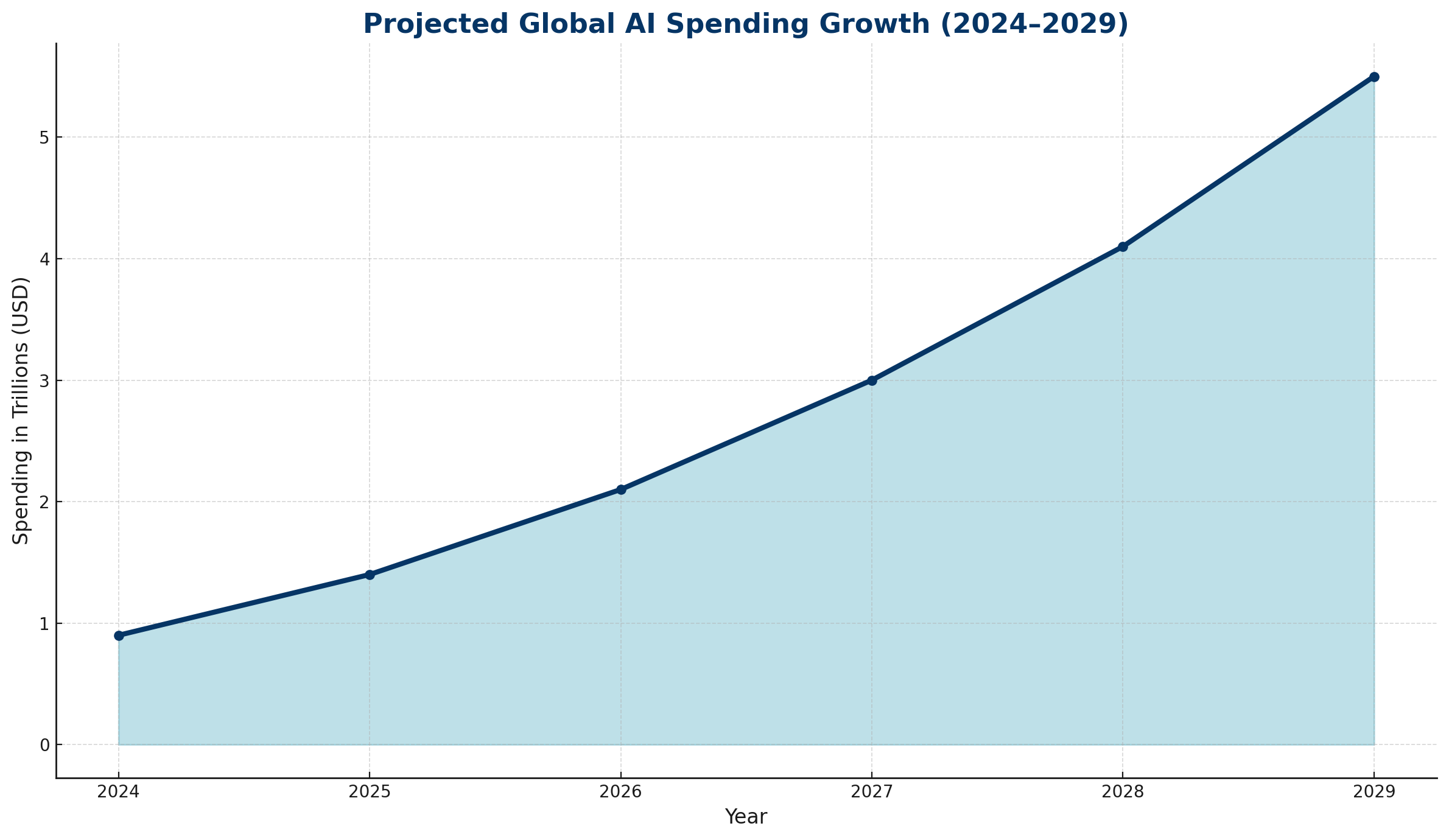

These substantial investments underscore the critical importance and transformative potential of AI across various sectors.

“The AI opportunity today mirrors the early days of the internet—only faster and deeper.” – MIT Sloan Management Review

We’re not witnessing another hype cycle. We’re navigating a generational inflection point where the convergence of cloud computing, machine learning, and quantum leaps in hardware efficiency is redefining the rules of value creation.

Despite the breakthroughs, most companies are still in AI adolescence. According to Strategy+Business, only 11% of enterprises have operationalized AI at scale. The reasons? Legacy infrastructure, siloed data, and leadership inertia.

For CEOs and private investors alike, this presents a rare asymmetry: widespread belief in AI’s potential, but underexploited implementation across the enterprise landscape. This is where alpha is born.

Leaders who understand the strategic integration of AI—not just its technical promise—are poised to dominate. This includes automating decision cycles, personalizing customer engagement at scale, and deploying predictive analytics to de-risk capital allocation.

Major technology companies are making unprecedented investments in AI infrastructure:

Unlike publicly traded tech firms, many of the most promising AI applications are being developed in venture-backed and PE-funded firms. Bain Capital notes that private equity investment in AI-related ventures has grown over 85% annually since 2019.

Why? Private capital offers the long-term vision, patient timelines, and strategic guidance that AI innovation demands. It’s not just about funding—it’s about partnership, execution, and exponential scale.

“We’re seeing a paradigm shift—AI is not only transforming businesses, but also how capital itself is deployed.” – Harvard Business Review

From healthcare diagnostics to logistics optimization, vertical AI applications are outperforming legacy incumbents. For example, companies like PathAI, Tempus, and DataRobot are redefining industries with proprietary AI platforms. These are precisely the kinds of opportunities forward-thinking investors must seek.

Investing in AI is no longer optional—it’s foundational. But successful participation requires discernment. Here’s how HNW and UHNW investors can evaluate AI-focused opportunities:

AI is multidisciplinary—it cuts across software, hardware, robotics, biotech, finance, and beyond. This creates a vast landscape of emerging investment opportunities for those with the right frameworks and partners.

Contrary to dystopian narratives, the future of AI isn’t machine versus man—it’s machine augmenting human potential. Stanford’s Institute for Human-Centered AI (HAI) emphasizes the need to design AI systems that enhance well-being, promote equity, and preserve accountability.

For investors, this introduces a vital ESG dimension. The companies that win long-term will be those that align AI deployment with ethical frameworks, regulatory foresight, and societal benefit. Investing in human-centric AI is not only right—it’s smart capital stewardship.

And while regulation will certainly evolve, the clarity of purpose and ethical design will be the moat that sustains value over time.

We are at the ground floor of the next trillion-dollar wave. AI is not merely a technological trend—it is the architecture of tomorrow’s economy. As a CEO and investor, I see this not just in data—but in the strategic priorities of every boardroom I engage with.

For HNW and UHNW investors, the question is not whether to participate—it’s how to do so intelligently, ethically, and profitably. Those who move early, align with visionary partners, and back transformative ventures will not just generate outsized returns—they will shape the future.

“History belongs to the bold. In AI, the bold are just getting started.”

Join us at Zynergy—where we invest in the future of AI and the innovators who will define it.

Disclaimer: I am an investor of #Nvidia #Microsoft #Meta