Tariffs did not break the economy. AI did not peak. And 2026 is shaping up to reward investors who look beyond yesterday’s winners.

That was the core message from our latest strategy discussion, which examined two issues now dominating institutional capital conversations: the real impact of tariffs in 2025 and where markets are likely to rotate in 2026.

The headline surprise is straightforward. Despite dire forecasts earlier this year, tariffs have so far coincided with stronger growth, cooling inflation, and a shifting investment landscape that increasingly favors application-level AI and overlooked sectors.

For allocators managing long-duration capital, the implications are meaningful.

Tariffs in 2025: The Shock That Never Arrived

When new tariffs were introduced in early April, the prevailing view across Wall Street was that growth would slow and inflation would reaccelerate. Research desks warned of higher consumer prices, margin compression, and renewed stagflation risk.

What actually happened was more nuanced.

The effective global tariff rate rose to just 11.2 percent, reflecting a 10 percent base rate with targeted exceptions, including 50 percent tariffs on steel, aluminum, and copper. That increase proved far less disruptive than feared.

Several forces blunted the impact:

- Consumers and businesses accelerated on-shoring and re-shoring decisions.

- Supply chains adapted faster than models assumed.

- Many firms absorbed costs temporarily rather than passing them through.

Customs duties tell part of the story. Collections more than doubled from $77 billion to $195 billion in the government’s fiscal year ending September 30, 2025, including only 6 months of new tariffs.

This disconnect is why headline narratives missed the mark.

Growth and Inflation: Data That Changed the Debate

By the third quarter, macro data forced a reassessment.

GDP growth came in at 4.3 percent, exceeding both the prior month’s 3.8 percent and the 3.2 percent consensus forecast. Inflation continued to surprise to the downside. Headline CPI printed at 2.7 percent, while core CPI fell to 2.6 percent, its lowest level since March 2021.

Price increases in tariff-exposed categories like apparel, furniture, household goods, and motor vehicle parts were offset by powerful deflationary forces elsewhere:

- AI-driven productivity gains reduced service-sector cost inflation.

- Housing rents softened more quickly than expected.

- Energy prices declined, easing input costs across the economy.

There is an important caveat. Some merchants have delayed passing tariff-related costs to consumers while awaiting a Supreme Court decision on tariff authority, expected in late January or February 2026. That ruling could introduce modest inflation pressure next year, but it is unlikely to reverse the broader trend.

As one strategist put it, “The tariff shock got priced in. The productivity shock did not.”

Fiscal Policy Sets the Stage for 2026

Looking ahead, fiscal policy is poised to reinforce growth rather than restrain it.

Approximately $400 billion in fiscal stimulus is expected from the so-called “one big beautiful bill,” with roughly $250 billion coming from tax benefits on business investment. For capital-intensive industries, that matters more than consumer rebates ever could.

This fiscal backdrop supports continued expansion into 2026, particularly in sectors aligned with productivity, automation, and infrastructure modernization.

Market Leadership Is Already Rotating

Equity markets are signaling the next phase.

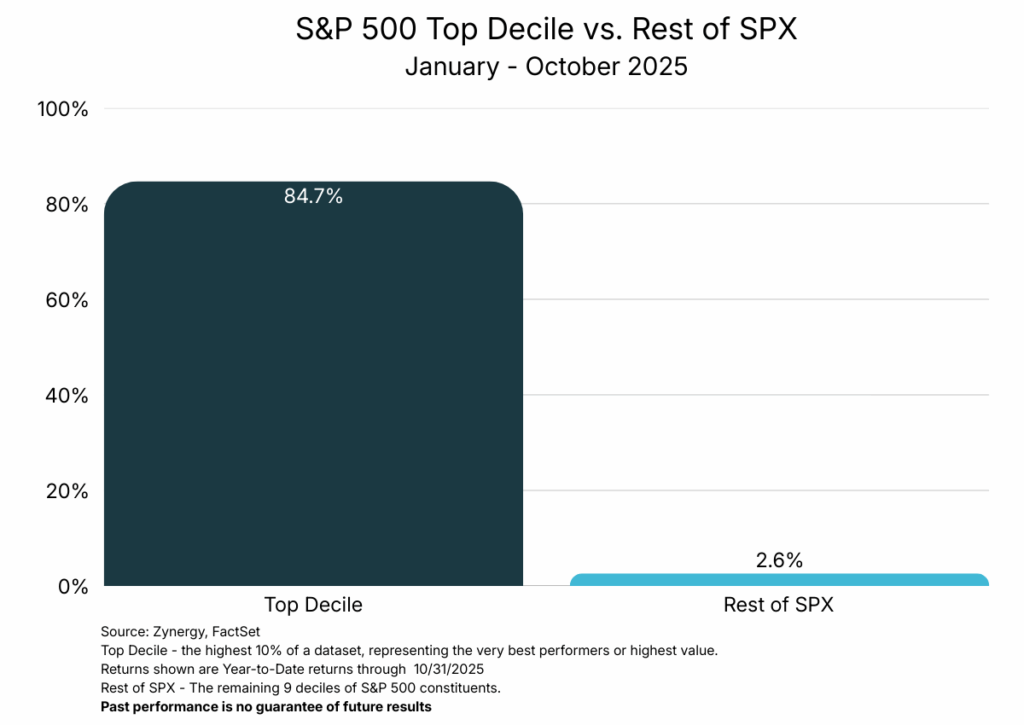

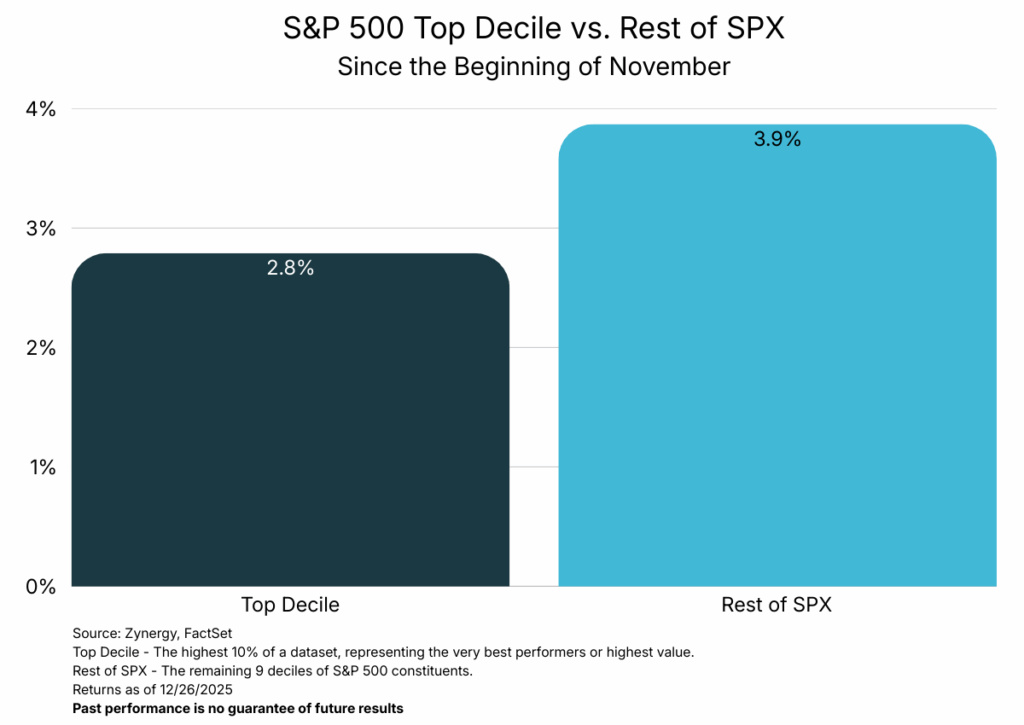

From January through October 2025, returns were dominated by a narrow group of technology companies and early AI beneficiaries. In the final two months of the year, leadership shifted sharply.

- Technology moved from top performer to bottom.

- Healthcare and materials surged into leading positions.

- Financials remained resilient, supported by a rate environment favorable to banks.

Rotation of this magnitude rarely happens without a deeper structural reason. In this case, it reflects where AI value is increasingly being realized.

The AI Value Chain: From Power to Applications

Power Generation: A Long-Dated Constraint

AI’s energy demands remain a binding constraint. Building new nuclear power plants takes six to ten years, excluding planning and regulatory timelines. Reactivating decommissioned facilities is also a multi-year process.

Small modular reactors offer lower upfront costs and enhanced safety, but most will not be operational until the mid-2030s. For 2026 investors, power generation itself remains a long-duration bet.

Grid Optimization: The Overlooked Near-Term Opportunity

The most actionable opportunity lies elsewhere. Grid optimization can unlock 15 to 25 percent more usable capacity by recovering stranded or curtailed energy, potentially adding hundreds of terawatt hours annually without building new generation.

Key solutions include dynamic line rating, advanced power flow control, and demand-side optimization through improved load shifting.

Unlike large infrastructure projects, these solutions rely on software and targeted hardware, allowing for rapid deployment and near-term cash flows.

From Bitcoin Mines to AI Data Centers

Another quiet transition is underway. Facilities originally built for Bitcoin mining are being repurposed into AI data centers.

Bitcoin operations struggled through much of 2025 and face continued pressure into 2026. AI workloads, by contrast, offer higher utilization and more stable profitability. Improved cooling systems that recycle heat further enhance economics.

Semiconductors: A Return to Normal

Semiconductors have stabilized after exceptional gains in 2025. Returns in 2026 are expected to be lower but still attractive, particularly for firms aligned with specialized AI workloads rather than commoditized chips.

Where AI Becomes Real: Applications

The most underappreciated opportunity sits at the end of the AI value chain.

Healthcare, materials, and industrials have been largely ignored in the AI narrative, yet these sectors are where productivity gains translate directly into margins and earnings growth.

AI-driven diagnostics, materials discovery, and industrial automation are moving from pilot programs to scaled deployment. This is where return on AI investment becomes visible on income statements.

2026 will not be about owning more AI. It will be about owning the right layer of the AI stack.

What This Means for Allocators

For family offices and institutional investors, the takeaway is not to abandon AI or fear tariffs. It is to refine exposure.

Opportunities are shifting from headline infrastructure plays toward grid intelligence, repurposed digital infrastructure, and AI-enabled applications in traditional sectors.

Join the conversation with Zynergy Insights, where innovation meets disciplined investing. Subscribe for monthly commentary on AI, innovation, and alternative investment strategies shaping the future of capital.