Overview: Riding the Second Wave

As we settle into the final quarter of 2025, markets are being quietly reshaped beneath the surface. This October update centers on a cohesive—and provocative—hypothesis: the next decade of returns will be won in the middle ground, not at extremes. In short, the winners won’t be the first-tier mega-caps nor the micro-names that flirt with mania—they’ll be those capable of embracing AI integration, capturing the rebound in broad equity participation, and aligning with the resurgence of onshoring.

Here are our three overarching themes for this month’s dispatch:

- AI Stocks Not Yet in Bubble Territory — While 54 percent of fund managers now flag AI as bubble risk, we see room for disciplined growth.

- Market Broadening Creating Active Management Opportunities — The widening of equity leadership beyond the Magnificent Seven is a structural shift, not a fad.

- Onshoring Momentum Accelerating — Strategic capital is pouring into domestic semiconductor capacity and rare earth value chains, creating durable moats.

Overall, we remain constructive. Yes, pockets of froth exist. Yes, geopolitical and macro risks lurk. But we believe a controlled soft-landing path, combined with strong earnings execution and eventual Fed rate cuts, will carry equities higher into year-end. Tactical caution is warranted, but conviction should not be absent.

AI Stocks Not Yet in Bubble Territory

The perception of excess in AI has grown loud. In Bank of America’s latest Global Fund Manager Survey, 54 percent of participants now view AI stocks as being in a bubble. That’s a record high, and it ought to prompt reflection—not panic. 1

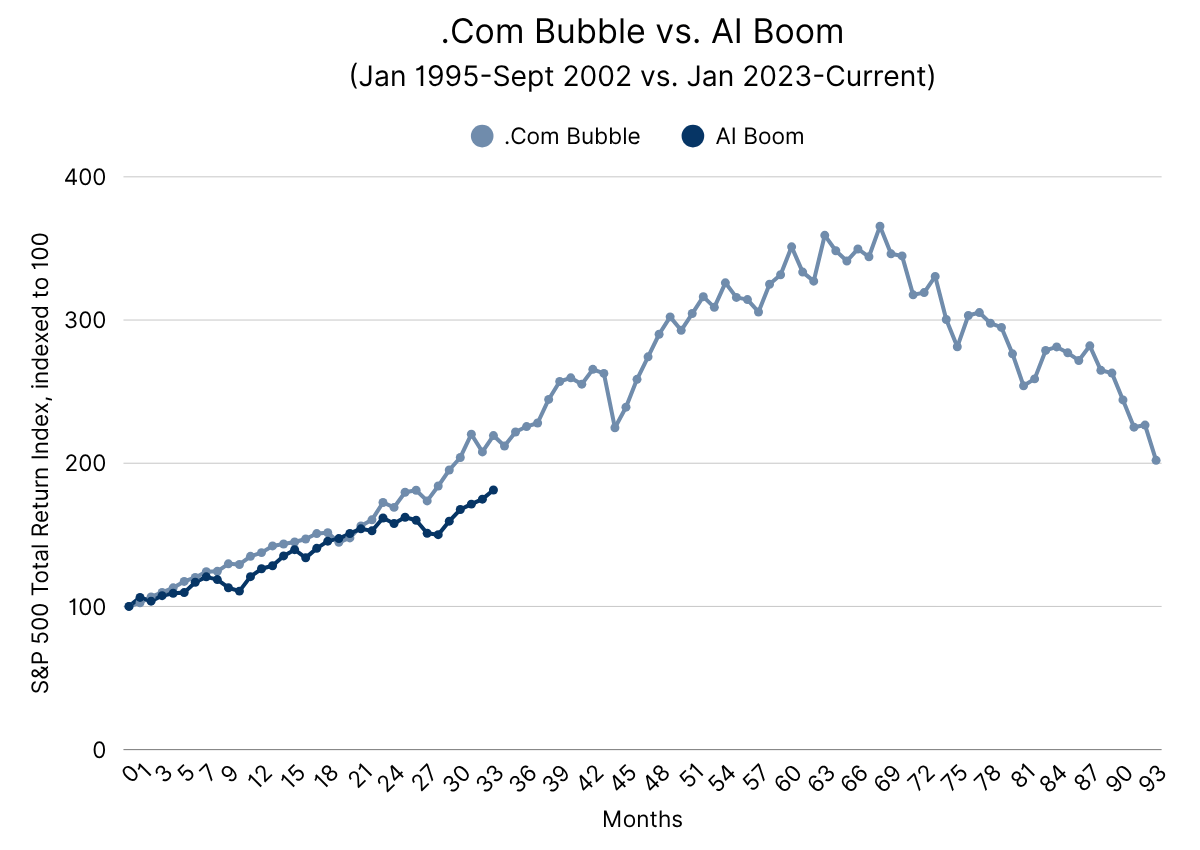

Yet the comparisons to the dot-com era still overstate the case. Recall: the World Wide Web entered public domain in 1993, the bubble peaked in March 2000, and the full capitulation came in 2002. That suggests a multi-year arc of expansion, every stage with its own internal dynamics.

Today, tech / AI stocks trade at forward P/Es in the range of ~30×. At the dot-com apex, average valuations soared to 55x. That differential argues that while froth is present, the bar to explosion is not yet breached.

Source: Zynergy, FactSet. Past Performance is No Guarantee of Future Results.

We distinguish between froth in select sub-segments (model-only plays, speculative AI infrastructure names without balance sheets, names without revenue) versus core and opportunistic AI names that embed real productivity upside. The latter set remains our favored space.

We believe that the real upside levers will come from earnings growth—driven by AI-aided efficiencies, automation, and cross-business embedding—rather than sheer multiple expansion. AI is a tailwind, not a substitute for fundamentals.

As for macro backdrop, it remains mixed. The labor market is softening, consumer confidence is unsettled, and unemployment is trending higher. But real GDP growth continues to hold—buoyed by investment and residual consumer strength. AI’s role is to act as a shock absorber in the leaner environment ahead.

In short: the AI cycle is far from over, but the window for indiscriminate exposure is closing. The prudent path is selective participation in names that can validate valuation through execution.

Market Broadening Creating Active Management Opportunities

One of 2025’s more consequential shifts is the slow unwinding of extreme market concentration. For years, a handful of names carried the index. Now, returns are broadening. That means more alpha zones, more divergence, more opportunity.

Goldman Sachs’ Equity Outlook: The Year of the Alpha Bet underscores this shift: they argue that index returns in 2025 will increasingly depend on earnings dispersion and stock selection rather than uniform multiple expansion. 2

Moreover, in their Asset Management “Market Pulse” commentary, Goldman notes that equity valuations currently reflect expectations of roughly 2.3% GDP growth in 2026, implying that upside will lean heavily on operational improvements rather than top-line fixation. 3

This dovetails with what we see: small- and mid-cap names are showing upward earnings revision momentum. Analysts at Goldman suggest that multiple support has room to rebound if dispersion reasserts itself.

Our posture is that the second wave of outperformance lies beyond the mega-cap frontier—in mids, in industrious names, in rotation plays. To succeed, active managers must be nimble, research-intensive, and ready to rotate with regime shifts.

For Zynergy, the mandate is clear: lean on AI and growth as the structural core, but balance that equilibrium with disciplined, tactical allocations into sectors that are actively re-rating—energy, infrastructure, upstream materials, and onshoring plays that stand to benefit from secular transitions already underway. The days of passive exposure in a top-heavy index are fading; alpha now lies in optionality, agility, and rigorous due diligence. The margin for error is shrinking, and precision in capital deployment will define the outperformers of this next phase.

One caution: as breadth returns, the noise goes up. You will see more false starts and crowd-chasing impulses. But discipline in idea vetting will be rewarded.

Onshoring Momentum Accelerating

If there is one structural shift that will define industrial capital allocation for the next decade, it’s the onshoring of strategic supply chains: semiconductors, rare earth processing, magnet manufacturing, and more.

In the semiconductor arena, TSMC, Samsung, and SK Hynix are all pursuing U.S. expansions. These are capital-intensive, multi-decade bets, underpinned by tax incentives, government subsidies, and geopolitical urgency.

Rare earths and magnet materials are perhaps an even more critical domain. China’s dominance of processing has been increasingly weaponized via export controls. The U.S. and allies now see processing, magnet manufacturing, and recycling as national security imperatives.

A concrete case: Germany’s VAC (Vacuumschmelze) has partnered with GM to build a rare earth processing plant in South Carolina. The facility is slated to be operational by year-end and is designed to handle ~2,000 metric tons at full tilt, converting rare earth oxides into magnet components. 4

This initiative isn’t isolated. Downstream processing, magnet alloying, precision manufacturing—all nodes are attracting capital. The U.S. Department of Defense has weaponized demand through grants, offtake guarantees, and anchor contracts.

This isn’t about chasing hype. This is about positioning in the verticals that sit between raw inputs and industrial applications.

Zynergy, if it plays in this ecosystem (or adjacent), should highlight its positioning clearly. The narrative shift alone—from demand pull (AI) to supply push (onshoring)—reshapes investment architecture.

The “Second Wave” Thesis: Why the Middle Ground Might Outperform

Across AI, broadening, and onshoring, a unifying thesis emerges: the second wave—those who follow, embed, and scale—will outpace the first movers alone.

Early-mover mega names capture headlines and initial capital. But the enduring returns come from adaptive operators—firms that can layer AI into legacy domains, reengineer margins, and pivot into adjacent verticals. The second wave is about depth, resilience, and composability.

Early AI adopters get rich first; the second wave are the companies that leverage AI to transform legacy sectors, reengineer margins, and unlock latent value. In the same way, the first wave of onshoring winds goes to headline pluses (TSMC, GM-VAC), while the second wave will go to component makers, recyclers, utility integrators, specialty materials, and logistics firms that attach to the backbone.

The middle ground is where nimble active management thrives—balancing growth, rotation, valuation discipline, and convex optionality.

Market Pulse: Indicators Worth Watching

To stay aligned with the second wave thesis, here are four critical barometers for October and beyond:

- Earnings Revisions in Small- and Mid-Cap Indices

If the Russell 2000 show sustained upward revisions, it confirms that the breadth of profit strength is widening. Goldman commentary hints at this rotation already forming. - Capex and AI Infrastructure Spend

Monitor semiconductor capital equipment firms, cloud and hyperscaler disclosures, and AI infrastructure vendors. An acceleration beyond expectations would fuel multiple expansion. - New Onshore Investment Announcements in Critical Supply Chains

Every new plant, processing facility, magnet factory, recycling hub gives discrete signals of capital deployment into the value chains of tomorrow. - Fed Policy & Earnings Surprises

The market is priced for two more rate cuts this year. If the Fed holds or earnings broadly disappoint, corrections are possible. Conversely, dovish surprise plus strong execution sets the stage for multiple expansion. - Valuation Spread Compression

Watch the spread between small/mid and large-cap forward P/Es. If the discount compresses meaningfully, capital is rotating inward.

Tactical Observations: What is Zynergy Emphasizing and Avoiding

- Trim speculative AI pure plays — Names without moat, and those with priced on hype, with stretched valuations are vulnerable when volatility reappears.

- Favor structurally advantaged firms with discipline — The winners will embed AI, control cost structures, and validate valuation through growth.

- Balance growth and industrial exposure — The next cycle’s returns will be driven primarily by earnings growth, not just multiple expansion.

Overall Investment Outlook

From an investor’s lens, the late-2025 landscape is compelling. Tactical volatility is likely, especially in October (recall the classic Sept–Oct drawdowns). But the absence of a full-blown correction thus far suggests underlying strength.

We expect a traditional year-end rally. History says not to fight that kind of momentum. But this year, the rally will likely rotate—less about mega-cap dominance and more about broad participation, cross-sector revival, and industrial reallocation.

That said, the outlook hinges on two key pillars:

- Earnings must deliver (both trailing and forward). If AI augments margins, if industrials respond to capex, and if onshoring begins to show embedded ROI, markets will reward.

- The Fed must deliver on cuts. If the promised easing is delayed or reversed, multiple compression is a clear risk.

If both pillars hold, we believe equities can deliver strong total returns into 2026—but with a different composition than the last decade. The second wave belongs to the flexible, the adaptive, and the industrially anchored.

For Zynergy, this is a moment of deliberate execution. Our strategy is not simply to chase growth but to align with the structural shifts reshaping global markets—embedding AI into real productivity gains, strengthening exposure to the industrial backbone, and positioning capital where onshoring and technological transformation converge.

We will continue to monitor the key inflection points—small cap breadth, AI capex growth, onshore investment flows, and Fed pivots. But our base case is clear: we’re not at the top. We’re riding the second wave—and the upside ahead is in the depth, not just the breadth.

Sources:

1 BofA’s survey shows 54% of investors say AI in bubble, 60% say stocks overvalued – @Senad Karaahmetovic

2 Goldman Sachs Equity Outlook 2025: The Year of the Alpha Bet

3 Goldman Sachs Asset Management “Market Pulse” Commentary (September 2025)

average valuations soared to 55x.

October 2025 Market Insights: Riding the Second Wave – The Explosive Shifts Powering the Next Market Breakout

Overview: Riding the Second Wave

As we settle into the final quarter of 2025, markets are being quietly reshaped beneath the surface. This October update centers on a cohesive—and provocative—hypothesis: the next decade of returns will be won in the middle ground, not at extremes. In short, the winners won’t be the first-tier mega-caps nor the micro-names that flirt with mania—they’ll be those capable of embracing AI integration, capturing the rebound in broad equity participation, and aligning with the resurgence of onshoring.

Here are our three overarching themes for this month’s dispatch:

Overall, we remain constructive. Yes, pockets of froth exist. Yes, geopolitical and macro risks lurk. But we believe a controlled soft-landing path, combined with strong earnings execution and eventual Fed rate cuts, will carry equities higher into year-end. Tactical caution is warranted, but conviction should not be absent.

AI Stocks Not Yet in Bubble Territory

The perception of excess in AI has grown loud. In Bank of America’s latest Global Fund Manager Survey, 54 percent of participants now view AI stocks as being in a bubble. That’s a record high, and it ought to prompt reflection—not panic. 1

Yet the comparisons to the dot-com era still overstate the case. Recall: the World Wide Web entered public domain in 1993, the bubble peaked in March 2000, and the full capitulation came in 2002. That suggests a multi-year arc of expansion, every stage with its own internal dynamics.

Today, tech / AI stocks trade at forward P/Es in the range of ~30×. At the dot-com apex, average valuations soared to 55x. That differential argues that while froth is present, the bar to explosion is not yet breached.

Source: Zynergy, FactSet. Past Performance is No Guarantee of Future Results.

We distinguish between froth in select sub-segments (model-only plays, speculative AI infrastructure names without balance sheets, names without revenue) versus core and opportunistic AI names that embed real productivity upside. The latter set remains our favored space.

We believe that the real upside levers will come from earnings growth—driven by AI-aided efficiencies, automation, and cross-business embedding—rather than sheer multiple expansion. AI is a tailwind, not a substitute for fundamentals.

As for macro backdrop, it remains mixed. The labor market is softening, consumer confidence is unsettled, and unemployment is trending higher. But real GDP growth continues to hold—buoyed by investment and residual consumer strength. AI’s role is to act as a shock absorber in the leaner environment ahead.

In short: the AI cycle is far from over, but the window for indiscriminate exposure is closing. The prudent path is selective participation in names that can validate valuation through execution.

Market Broadening Creating Active Management Opportunities

One of 2025’s more consequential shifts is the slow unwinding of extreme market concentration. For years, a handful of names carried the index. Now, returns are broadening. That means more alpha zones, more divergence, more opportunity.

Goldman Sachs’ Equity Outlook: The Year of the Alpha Bet underscores this shift: they argue that index returns in 2025 will increasingly depend on earnings dispersion and stock selection rather than uniform multiple expansion. 2

Moreover, in their Asset Management “Market Pulse” commentary, Goldman notes that equity valuations currently reflect expectations of roughly 2.3% GDP growth in 2026, implying that upside will lean heavily on operational improvements rather than top-line fixation. 3

This dovetails with what we see: small- and mid-cap names are showing upward earnings revision momentum. Analysts at Goldman suggest that multiple support has room to rebound if dispersion reasserts itself.

Our posture is that the second wave of outperformance lies beyond the mega-cap frontier—in mids, in industrious names, in rotation plays. To succeed, active managers must be nimble, research-intensive, and ready to rotate with regime shifts.

For Zynergy, the mandate is clear: lean on AI and growth as the structural core, but balance that equilibrium with disciplined, tactical allocations into sectors that are actively re-rating—energy, infrastructure, upstream materials, and onshoring plays that stand to benefit from secular transitions already underway. The days of passive exposure in a top-heavy index are fading; alpha now lies in optionality, agility, and rigorous due diligence. The margin for error is shrinking, and precision in capital deployment will define the outperformers of this next phase.

One caution: as breadth returns, the noise goes up. You will see more false starts and crowd-chasing impulses. But discipline in idea vetting will be rewarded.

Onshoring Momentum Accelerating

If there is one structural shift that will define industrial capital allocation for the next decade, it’s the onshoring of strategic supply chains: semiconductors, rare earth processing, magnet manufacturing, and more.

In the semiconductor arena, TSMC, Samsung, and SK Hynix are all pursuing U.S. expansions. These are capital-intensive, multi-decade bets, underpinned by tax incentives, government subsidies, and geopolitical urgency.

Rare earths and magnet materials are perhaps an even more critical domain. China’s dominance of processing has been increasingly weaponized via export controls. The U.S. and allies now see processing, magnet manufacturing, and recycling as national security imperatives.

A concrete case: Germany’s VAC (Vacuumschmelze) has partnered with GM to build a rare earth processing plant in South Carolina. The facility is slated to be operational by year-end and is designed to handle ~2,000 metric tons at full tilt, converting rare earth oxides into magnet components. 4

This initiative isn’t isolated. Downstream processing, magnet alloying, precision manufacturing—all nodes are attracting capital. The U.S. Department of Defense has weaponized demand through grants, offtake guarantees, and anchor contracts.

This isn’t about chasing hype. This is about positioning in the verticals that sit between raw inputs and industrial applications.

Zynergy, if it plays in this ecosystem (or adjacent), should highlight its positioning clearly. The narrative shift alone—from demand pull (AI) to supply push (onshoring)—reshapes investment architecture.

The “Second Wave” Thesis: Why the Middle Ground Might Outperform

Across AI, broadening, and onshoring, a unifying thesis emerges: the second wave—those who follow, embed, and scale—will outpace the first movers alone.

Early-mover mega names capture headlines and initial capital. But the enduring returns come from adaptive operators—firms that can layer AI into legacy domains, reengineer margins, and pivot into adjacent verticals. The second wave is about depth, resilience, and composability.

Early AI adopters get rich first; the second wave are the companies that leverage AI to transform legacy sectors, reengineer margins, and unlock latent value. In the same way, the first wave of onshoring winds goes to headline pluses (TSMC, GM-VAC), while the second wave will go to component makers, recyclers, utility integrators, specialty materials, and logistics firms that attach to the backbone.

The middle ground is where nimble active management thrives—balancing growth, rotation, valuation discipline, and convex optionality.

Market Pulse: Indicators Worth Watching

To stay aligned with the second wave thesis, here are four critical barometers for October and beyond:

If the Russell 2000 show sustained upward revisions, it confirms that the breadth of profit strength is widening. Goldman commentary hints at this rotation already forming.

Monitor semiconductor capital equipment firms, cloud and hyperscaler disclosures, and AI infrastructure vendors. An acceleration beyond expectations would fuel multiple expansion.

Every new plant, processing facility, magnet factory, recycling hub gives discrete signals of capital deployment into the value chains of tomorrow.

The market is priced for two more rate cuts this year. If the Fed holds or earnings broadly disappoint, corrections are possible. Conversely, dovish surprise plus strong execution sets the stage for multiple expansion.

Watch the spread between small/mid and large-cap forward P/Es. If the discount compresses meaningfully, capital is rotating inward.

Tactical Observations: What is Zynergy Emphasizing and Avoiding

Overall Investment Outlook

From an investor’s lens, the late-2025 landscape is compelling. Tactical volatility is likely, especially in October (recall the classic Sept–Oct drawdowns). But the absence of a full-blown correction thus far suggests underlying strength.

We expect a traditional year-end rally. History says not to fight that kind of momentum. But this year, the rally will likely rotate—less about mega-cap dominance and more about broad participation, cross-sector revival, and industrial reallocation.

That said, the outlook hinges on two key pillars:

If both pillars hold, we believe equities can deliver strong total returns into 2026—but with a different composition than the last decade. The second wave belongs to the flexible, the adaptive, and the industrially anchored.

For Zynergy, this is a moment of deliberate execution. Our strategy is not simply to chase growth but to align with the structural shifts reshaping global markets—embedding AI into real productivity gains, strengthening exposure to the industrial backbone, and positioning capital where onshoring and technological transformation converge.

We will continue to monitor the key inflection points—small cap breadth, AI capex growth, onshore investment flows, and Fed pivots. But our base case is clear: we’re not at the top. We’re riding the second wave—and the upside ahead is in the depth, not just the breadth.

Sources:

1 BofA’s survey shows 54% of investors say AI in bubble, 60% say stocks overvalued – @Senad Karaahmetovic

2 Goldman Sachs Equity Outlook 2025: The Year of the Alpha Bet

3 Goldman Sachs Asset Management “Market Pulse” Commentary (September 2025)

Larry McKay, CFA, CTFA

Zynergy Ventures, LLC and Zynergy Holdings, LLC (collectively referred to as "Zynergy") is a private investment firm. This commentary is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. The content herein discusses broad market, industry, or sector trends, as well as general economic, market, or political conditions. It has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any specific investment recommendation.

The views expressed in this commentary are the personal views of the authors and do not necessarily reflect the views of Zynergy. These views are current as of the date of publication and are subject to change without notice. Neither the authors nor Zynergy assumes any obligation to update or revise any statements to reflect new information or future events.

Zynergy and individuals or entities affiliated with it may hold positions in or conduct transactions involving securities of companies mentioned or indirectly referenced in this commentary. Zynergy may also offer related investment strategies to third parties for compensation within asset classes mentioned or discussed herein.

Investment ideas and concepts mentioned may not be suitable for all investors depending on individual investment objectives, risk tolerance, or financial circumstances. Margin requirements, transaction costs, commissions, and tax implications should be carefully reviewed with the guidance of qualified investment and tax professionals.

All information contained in this commentary is believed to be accurate and obtained from public sources deemed reliable as of the date of issuance. However, no warranty, express or implied, is provided regarding the completeness or accuracy of such information. Past performance does not predict future returns.