International Equities Resurgence

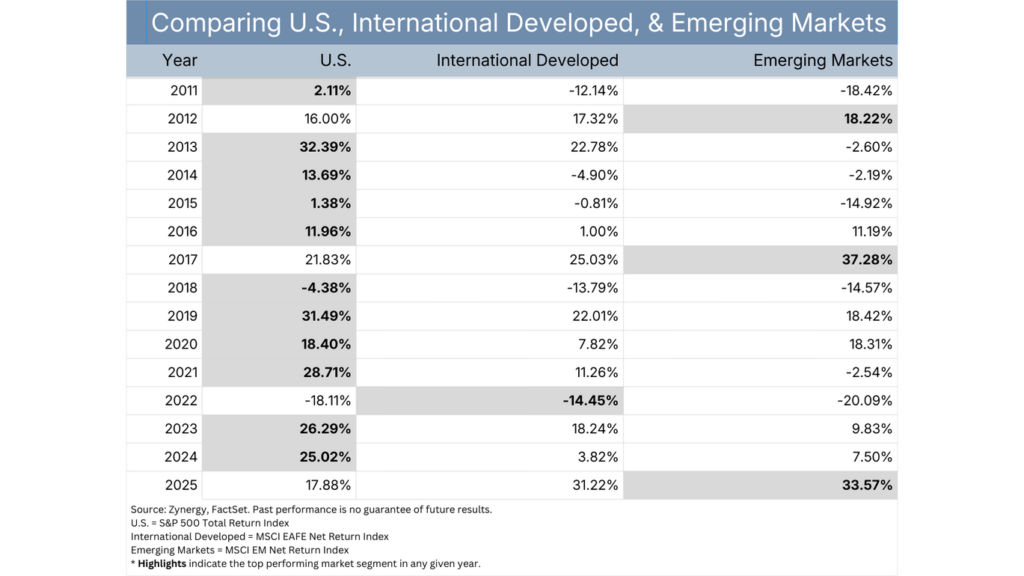

As we enter January 2026, global equity markets are undergoing a structural reset that has meaningful implications for long-term portfolios. For more than a decade, US equities dominated performance. In fact, US markets outperformed international developed and emerging markets in 11 of the last 15 years. That era of near-uninterrupted US leadership is now being challenged by data, policy, and capital flows.

Companies worldwide are prioritizing strategic autonomy, industrial resilience, and domestic capacity. Governments are reinforcing these shifts through incentives, trade policy, and infrastructure spending. The result is a more fragmented, regionally focused global economy. Importantly for investors, this environment supports higher potential returns outside the United States.

International markets are no longer simply a muted extension of US growth.. They are developing independent earnings drivers, differentiated sector exposures, and policy backdrops that matter again.

“The benefits of global diversification are no longer theoretical. They are becoming measurable.”

Diversification Benefits Are Back

For much of the past decade, diversification disappointed investors. Correlations across global equity markets remained elevated, meaning international allocations provided limited downside protection during US-led drawdowns. Deglobalization has changed that dynamic.

Economic decentralization is creating real dispersion in growth, inflation, and monetary policy. Supply chains are regionalizing. Fiscal priorities differ across countries. Corporate margins are increasingly driven by local conditions rather than global demand cycles.

This fragmentation is restoring diversification benefits that were largely absent since the global financial crisis. Larger international allocations now have the potential to reduce overall portfolio volatility while improving risk-adjusted returns. For investors focused on capital preservation alongside growth, this shift is significant.

Supply Chain Restructuring Drives Repricing

One of the clearest catalysts for international opportunity is supply chain restructuring. Years of efficiency-first globalization are being replaced by redundancy, resilience, and political alignment.

Repricing is occurring across the United States and Europe as production networks are reconfigured. Capital expenditure is flowing toward countries that offer manufacturing scale, workforce depth, and geopolitical neutrality. Notably, production is shifting away from China toward Vietnam, Mexico, India, and Eastern Europe.

These changes are not cyclical. They represent long-duration capital commitments that support local employment, wage growth, and corporate earnings. Equity markets in these regions are beginning to reflect that reality.

Sector Composition Advantages Abroad

Sector composition is another tactical tailwind for international equities. International developed markets carry heavier weightings in financials and industrials compared to the technology-heavy exposure that defines US markets.

This matters in the current environment. Technology weakness, both in the US and abroad, has shifted leadership toward sectors tied to physical infrastructure, manufacturing, and applied innovation. Industrials, materials, and healthcare companies deploying AI at the operational level are benefiting, even as headline tech multiples compress.

International markets are particularly well positioned here. Their exposure aligns with global investment in energy systems, logistics, automation, and healthcare capacity. At the same time, similar opportunities are emerging in underappreciated US sectors, reinforcing the case for balanced global exposure rather than concentrated bets.

Country-Specific Opportunities

Several countries stand out as examples of this broader shift.

Japan has outperformed the United States for four consecutive years. This performance has occurred alongside a domestic AI investment surge and continued corporate governance reform. Higher return-on-equity targets, improved capital allocation, and shareholder-friendly policies are supporting earnings growth and valuation expansion.

South Korea presents a different but equally compelling case. Korea’s private sector has committed approximately $49 billion to AI-related projects through 2027. The country’s strength in hardware components, particularly DRAM and advanced memory, positions it at the center of global AI infrastructure, not just software narratives.

These are not isolated stories. They reflect how national policy, corporate behavior, and sector specialization are converging to create differentiated return paths.

Emerging Markets, Commodities, and Currency Dynamics

Currency trends are reinforcing these opportunities. Early 2026 dollar weakness is already evident, easing financial conditions for emerging markets and supporting commodity demand. Lower dollar pressure reduces funding stress while boosting export competitiveness for commodity-producing economies.

Commodities have responded accordingly. Gold, silver, copper, and tin are trading at all-time highs. Energy, which struggled through much of last year, has regained momentum and is the best-performing US sector year-to-date, with materials close behind.

Notably, Bitcoin continues to trend lower despite last year’s decline, underscoring the rotation from speculative assets toward real assets and cash-generating businesses. Emerging market commodity exporters stand to benefit disproportionately from this environment.

Investment Implications

For US-based investors, the message is clear. Avoiding international exposure because of past US dominance risks missing a meaningful regime change. The structural forces supporting international equities are broad, durable, and increasingly visible in earnings data.

Key considerations include:

- Increasing allocations to international developed and select emerging markets

- Emphasizing sectors tied to infrastructure, industrials, and applied AI

- Viewing commodities and energy as complements, not hedges

The trend toward international outperformance is not guaranteed, but it is supported by fundamentals that have been absent for more than a decade.

Join the conversation with Zynergy Insights, where innovation meets disciplined investing. Subscribe for monthly commentary on AI, innovation, and alternative investment strategies shaping the future of capital.