The market’s center of gravity in 2025 is simple: corporate earnings are doing the heavy lifting while policy risk is rising at the edges. Q2 earnings grew ~13%—double early estimates—despite heavy AI capex, underscoring durable U.S. profit power. Nvidia’s slight miss didn’t change the structural story: a 56% revenue surge with guidance for another record quarter keeps AI infrastructure as the market’s flywheel. Meanwhile, China’s tech stack still trails U.S. leadership even as Alibaba rolls out competing chips.

Policy is the wild card. A 50% U.S. tariff on India (and the threat of conditioning relief on Russian oil) could redirect near-term supply chains from India toward Vietnam and Mexico, accelerating “ally-shoring.” Canada–U.S. frictions just reverted to status quo, but the U.S. taking a 10% equity stake in Intel is a line-crossing moment—state involvement without a financial crisis backdrop raises a “policy beta” investors must price. Separately, attempts to oust a sitting Fed governor for alleged misconduct flirt with the Fed’s independence at a time when the central bank is expected to cut again in September and December.

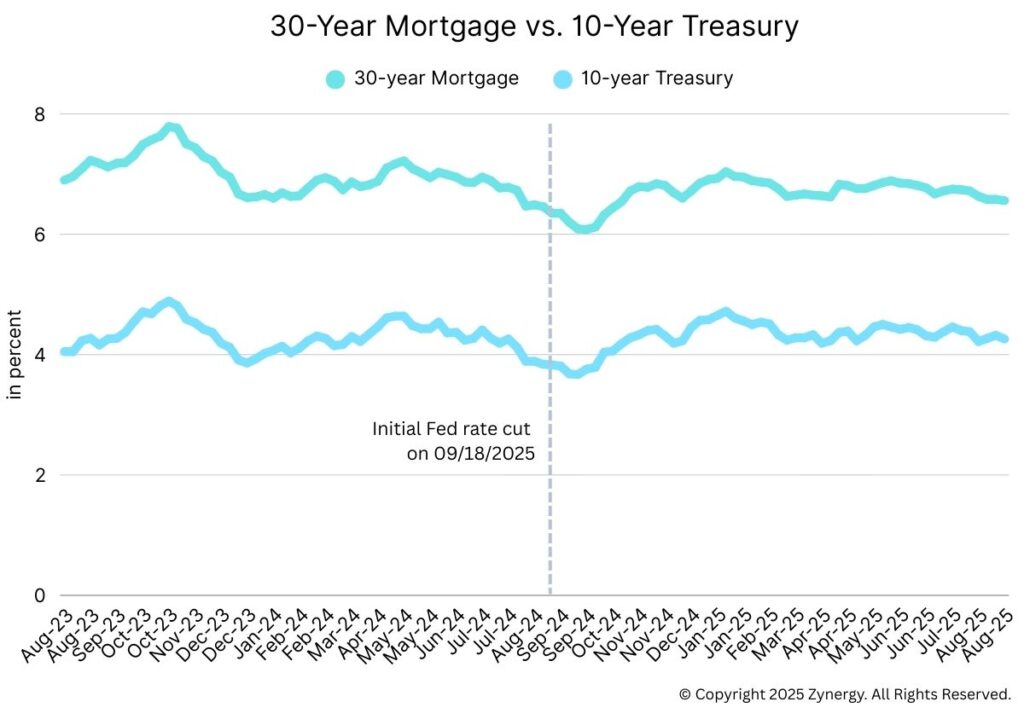

Macro remains mixed: inflation at ~3.1% sits above target and unemployment near 4.2% is historically low. The September 50 bps cut had little lasting effect on 10-year yields or mortgage rates—both drifted higher—reminding us that term premium and supply/demand for duration matter as much as the policy rate. Bottom line: rate cuts alone won’t rescue housing.

Valuations look stretched, but history is unequivocal—valuations are terrible timing tools. A seasonal pullback into September–October is possible, yet we don’t see the classic red flags (tight credit, collapsing earnings, or a funding seizure) that usually precede durable tops. Our stance: stay invested, upgrade quality, and use volatility—not headlines—to improve entries.

What to Watch (Next 30–60 Days)

Tariff chess: Does India bend on Russian crude? If tariffs stick, expect incremental flow to Mexico/Vietnam; watch rails, ports, industrial RE. Fed politics vs. economics: Any escalation around Fed governance could widen term premium; watch 10-year yield and breakevens. Earnings revisions: Particularly AI “picks & shovels” (compute, power, cooling, grid) and near-shoring beneficiaries. Credit spreads & USD: Early stress shows up here first; the dollar trend remains the macro umpire.

Political Developments

- Trump recently increased India’s tariffs to 50%; watch this over the next 1-2 months to see if India capitulates to Trump’s demand to stop purchasing Russian oil

- Canada negotiated and returned to the status quo after recent tariff disputes with the US

- The U.S. government taking a 10% stake in Intel marks unprecedented government involvement in a private company without a financial crisis justification

- U.S. trade has been shifting away from China primarily to India, Vietnam, and Mexico. If high tariffs on India remain, this may shift more U.S. demand to Vietnam and Mexico

- Trump’s attempt to fire Fed Governor Cook for alleged mortgage fraud raises concerns about Fed independence

- Fed independence appears threatened as partisan politics extends to previously nonpartisan institutions

- Fed rate cuts expected in September and December

- The previous Fed cut (50 bps in September) had a limited long-term impact on 10-year yields and mortgage rates, which have actually increased since then

- Current inflation at 3.1% (above target)

- These mixed indicators create competing rationales for Fed rate policy. Impending rate cuts may spur higher inflation

- Q2 earnings growth reached 13%, double the initial expectations

- Strong earnings growth occurred despite significant AI expenditures

- Nvidia slightly missed Wall Street expectations, but reported a 56% revenue jump, with expectations for another record quarter

- Alibaba announced competing chips, but analysts note that China still lags the US in technology

- Valuations appear stretched, but this has historically been a poor timing mechanism for market exits

- Despite a potential seasonal pullback in September-October, no major red flags for continued market growth

- Rate cuts are likely to have minimal impact on mortgage rates and the housing market

- Political involvement in private business and central banking presents concerning precedents

Federal Reserve and Monetary Policy

Economic Indicators

Market Performance and Outlook

Key Observations

Engage Zynergy

Schedule a CIO Briefing (20 minutes): We’ll translate this macro into your specific allocation and liquidity plan. Schedule Now

Due Diligence Pack: If you’re an accredited investor evaluating Zynergy’s hybrid evergreen strategy, ask for our latest memo, track record context, and governance framework.

This summary is for informational purposes only and is not investment advice. Investments involve risk, including possible loss of principal.