Executive Summary

November 2025 marked a transition from an AI-and-megacap–dominated tape toward a more balanced market structure. What appeared, at first glance, to be a “risk-off” move was in fact much more nuanced: a targeted valuation reset in crowded artificial intelligence and high-growth technology names, alongside improving relative strength in underappreciated sectors such as healthcare, consumer discretionary, and financials.

At the macro level, a more dovish tone from the New York Fed governor sharply increased the implied probability of a December rate cut—from below 50% to roughly 70%—easing pressure on discount rates and supporting the historical pattern of seasonally strong markets into year-end.

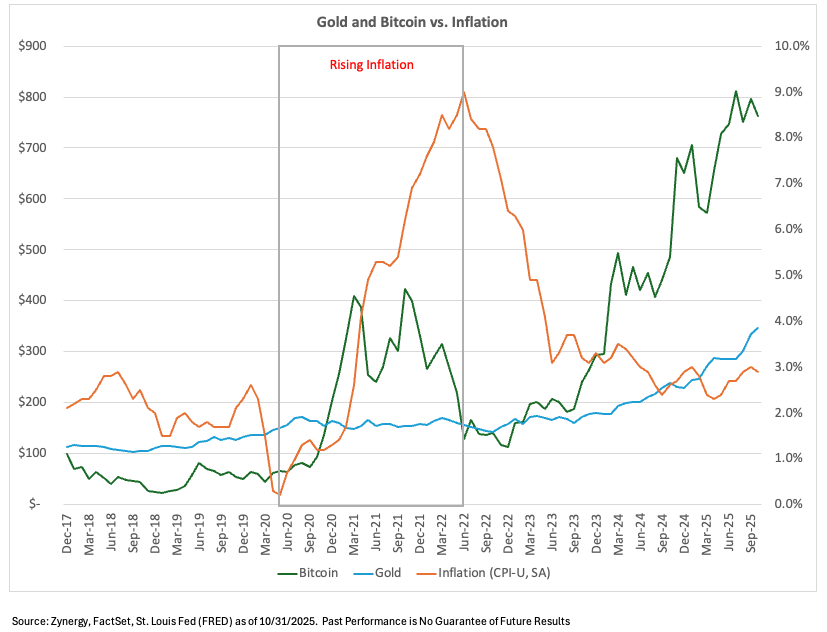

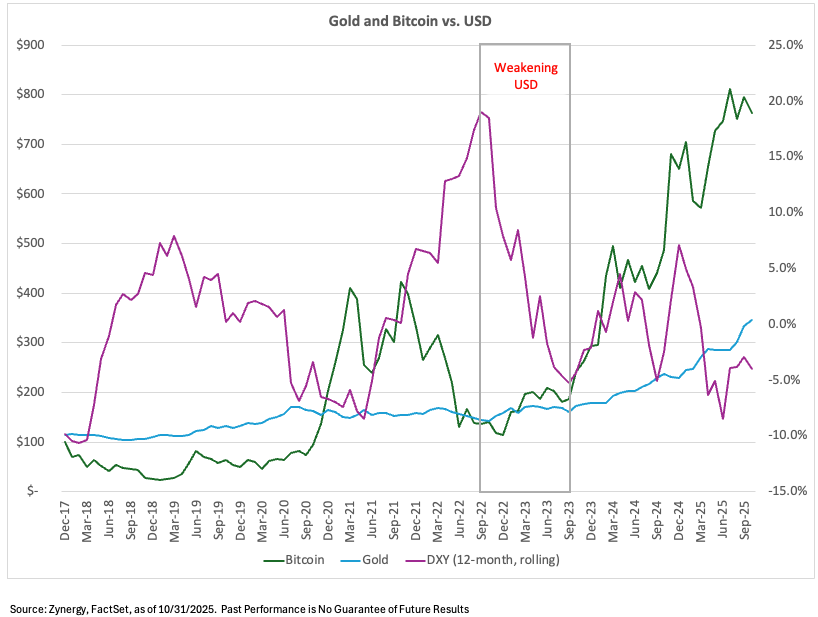

Against this backdrop, we revisit a recurring investor question: Is Bitcoin the new gold? Using data from January 2017 through January 2026, we examine how Bitcoin and gold have behaved relative to inflation and the U.S. dollar. The conclusion is clear but often overlooked:

- Bitcoin behaves primarily as a high-beta risk asset driven by idiosyncratic events.

- Gold, while imperfect, still behaves more like a long-term store of value and partial alternative to the U.S. dollar.

- Neither asset has delivered on the popular narrative of a reliable, systematic inflation hedge.

1. November’s Pullback: A Valuation Regime Shift, Not a Crisis

The recent pullback has been disproportionately concentrated in the inflated AI and high-growth tech names that led performance year-to-date. These were precisely the stocks that benefited from an extraordinary combination of narrative momentum, index concentration, and multiple expansion as investors extrapolated early AI productivity gains far into the future.1.1 Healthy Versus Harmful Corrections

From a “deep think” perspective, the critical task is to distinguish a healthy correction from the early stages of systemic stress. Several dynamics argue strongly for the former:- Concentration of Declines: Price damage has been focused in the most crowded AI software, semiconductor, and megacap growth names. Broader indices, equal-weighted baskets, and value-oriented groups have held up comparatively well. That pattern is characteristic of positioning and valuation resets, not liquidity crises.

- Stable Credit Conditions: There has been no parallel spike in credit spreads, no meaningful deterioration in funding markets, and no sign of balance sheet stress in major financial institutions. True systemic crises almost always originate in, or rapidly transmit through, credit—something we are not seeing.

- Rotation, Not Liquidation: Capital is not fleeing equities wholesale; instead, it is rotating. Underappreciated areas—healthcare, consumer discretionary, financials—have begun to show improving relative performance. This suggests investors are rebalancing toward more reasonably valued earnings streams, not abandoning risk altogether.

1.2 Sector Rotation: From Story to Substance

Throughout much of 2024 and into 2025, returns were heavily skewed toward a narrow group of AI beneficiaries. Now we are seeing:- Healthcare recovering as investors refocus on demographic tailwinds, non-cyclical demand, and innovation in biotech and medical technology that was overshadowed by the AI narrative.

- Consumer Discretionary benefiting from moderating inflation and resilient wage growth, which support real consumption even as headline growth normalizes.

- Financials finding support from a more supportive rate outlook, a modest steepening in portions of the yield curve, and solid credit quality.

2. The New York Fed and the Path to a December Cut

A key November development was the dovish messaging shift from the New York Fed governor, increasing the probability of a December rate cut to about 70%.Why This Matters

- Discount Rate Relief – Lower rate expectations ease valuation pressure.

- Sentiment Inflection – Investors now see the Fed balancing risks rather than solely fighting inflation.

- Seasonality Tailwind – Historically strong December returns + policy support = constructive environment.

3. Bitcoin vs Gold: What the Last Decade Actually Tells Us

The 2017–2026 period provides an unusually rich dataset because it includes several Bitcoin cycles, a historic inflation regime, multiple policy shifts, and major crypto-specific events. The data contradicts many popular narratives.3.1 Bitcoin and Inflation: The Hedge That Wasn’t

The 2020–2022 inflation spike should have validated Bitcoin’s inflation-hedge narrative. Instead:- Bitcoin showed negative correlation with inflation.

- Bitcoin fell sharply as liquidity tightened—behaving like a speculative tech asset.

- Gold underperformed relative to past inflation cycles due to rising real rates.

3.2 Bitcoin, Gold, and the U.S. Dollar: A More Plausible, Yet Inconsistent, Story

The dollar narrative is more plausible: both assets often rise when the U.S. dollar weakens.Dollar Strengthening (May 2021 – Sept 2022)

- Bitcoin: negative returns

- Gold: negative returns

Dollar Weakening (Sept 2022 – Sept 2023)

- Bitcoin: positive returns

- Gold: positive returns

3.3 Idiosyncratic Drivers: Why Bitcoin Is Primarily a Risk Asset

Bitcoin’s major moves are best explained by crypto-specific catalysts:Positive Drivers

- PayPal integration (Oct 2020)

- Tesla / MicroStrategy / Square adoption (2020)

- Coinbase IPO (Apr 2021)

- Spot ETF approvals (Jan 2024)

- Halving events (most recently 2024)

Negative Drivers

- China mining ban (May 2021)

- FTX collapse (Nov 2022)

3.4 Gold vs Bitcoin: Correlation, Role, and Reality

The long-term correlation between Bitcoin and gold is only 0.13—functionally uncorrelated.- Gold remains a diversifier and partial store-of-value.

- Bitcoin remains a speculative satellite allocation, not a macro hedge.

- Bitcoin negative YTD in 2024

- Gold at all-time highs

4. Strategic Implications for Investors

- The pullback is a reset, not a crisis.

- Rotate toward sectors with durable earnings and reasonable valuations.

- A dovish Fed + seasonality creates a constructive backdrop.

- Reframe Bitcoin as high-beta, not a hedge.

- Retain gold as a strategic store-of-value tool.

Closing Thoughts

November 2025 reinforces a key investing truth: markets evolve, narratives decay, and data clarifies reality.The AI-driven rally is maturing. The Fed is shifting toward balance. Bitcoin’s mythos is giving way to empiricism. Investors who distinguish rotation from crisis and ground decisions in evidence—not storylines—will be best positioned for long-term success.