Major Shifts That Must Be Considered By HNW Investors

Summary: Imagine your next financial portfolio is crafted not just by human judgment, but by an AI collaborator that learns and adapts in real time.

“I don’t know what’s going to happen over the next 10-years, but I suspect there will be a massive shake-up for traditional human financial advisors.”

In a recent live “marketing agent building session,” Relay.app’s CEO Jacob Bank argues that being able to construct AI agents will soon be as fundamental for finance professionals as mastering Word and Excel.

Together, these insights make it clear why “AI agents” are no longer a futuristic experiment, but an essential partner for anyone in finance. Whether you are a high-net-worth investor seeking the next edge in portfolio innovation, or a financial professional intending on amplifying your own expertise, AI agents promise to reshape workflows, accelerate insights, and redefine the very nature of financial management.

The Big Picture: Agentic AI Is Re-wiring Financial Services

Meet the colleague who never sleeps: AI agents are autonomous software programs that plan, reason, and act toward a goal with minimal human input, scanning data, making decisions, executing actions, and then learning from the outcomes in a closed feedback loop.

By combining real-time data ingestion with decision-making logic and self-improvement capabilities, these agents can handle open-ended problems that lack a fixed set of steps. For example, J.P. Morgan’s LOXM agent uses machine learning to intelligently fragment large equity orders across multiple venues, minimizing market impact and improving execution quality in real time. Trader surveys credit the model with a 15% lift in execution efficiency.

This wave of “Agentic AI” tops Gartner’s 2025 strategic-technology list, promising a virtual workforce that amplifies human talent. Deloitte’s latest survey of banking, insurance, and asset-management executives finds that 75% of firms already report measurable returns on their generative-AI programs.

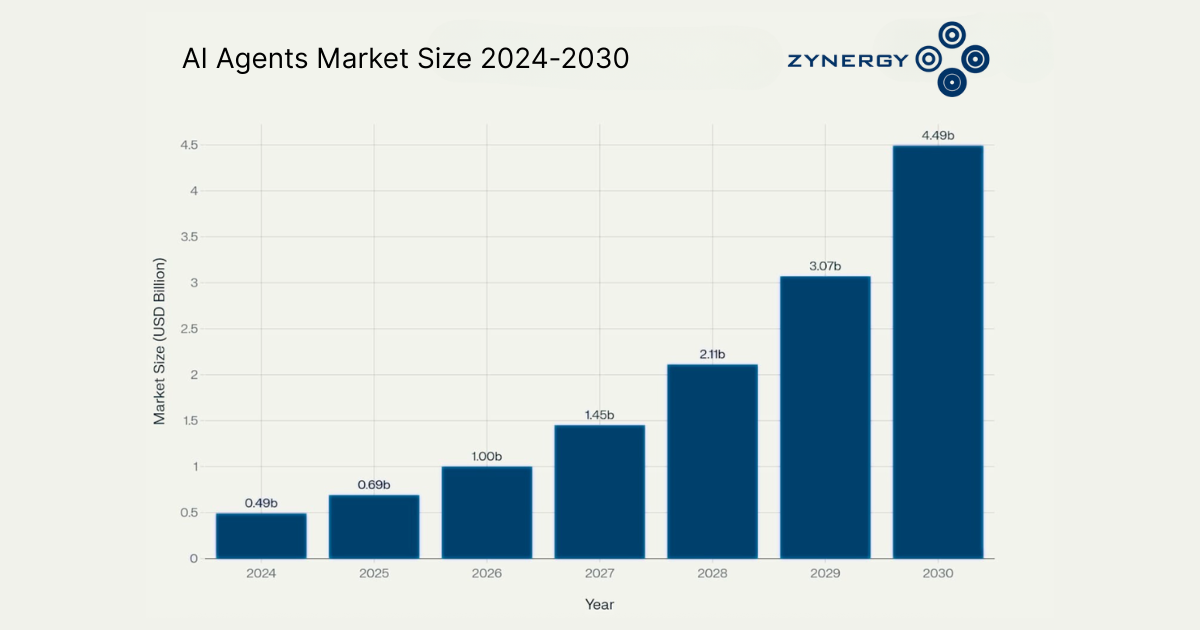

To further illustrate the scale and momentum of this shift, the chart below shows the projected growth of the global AI agents market in financial services through 2030.

Data from: GlobeNewswire/ResearchAndMarkets, “AI Agents in Financial Services: A $4.5 Billion Industry Opportunity by 2030,” May 2025

As shown, the market for AI agents in financial services is expected to accelerate from $490 million in 2024 to $4.49 billion by 2030, a compound annual growth rate of 45.4%. This trajectory underscores the rapid adoption of intelligent agents as essential tools for operational efficiency, risk management, and innovation across the industry.

Across finance, early deployments are delivering material for institutional investors, technologists, and industry experts:

- Risk & Compliance – Regulators such as Germany’s BaFin use AI agents to flag suspicious trades in real time, sharply reducing investigation cycles.

- Wealth & Portfolio Management – Robo-advisory platforms steward more than $600 billion in assets, providing continuous rebalancing and individualized tax-loss harvesting.

- M&A and Private Equity – Bain & Company projects that teams equipped with generative-AI diligence will identify acquisition targets faster and price risk with greater confidence over the next five years.

- Specialty Assets – In niche markets like fine wine, AI tools track provenance, pricing, and auction dynamics; industry studies expect more than $15 billion in additional online wine sales by 2028.

Industry leaders such as Moody’s and Auquan are already deploying multi-agent systems to accelerate financial analysis and research for clients like MetLife and UBS, demonstrating the tangible impact of agentic AI in high-stakes environments.

"AI agents excel in situations with open-ended problems, those that don’t have a fixed set of steps for resolution. This adaptability makes them especially valuable in portfolio management and investment research, where data is fragmented and time is of the essence."

How Zynergy Plans to Apply Decision-Support Agents

While agentic AI can touch every corner of finance, Zynergy is considering decision-support agents: systems that convert noisy, unstructured information into clear, defensible investment insights.

1. Data Triage & Trend Detection

Autonomous agents continuously scan pitch decks, regulatory filings, market news, and global auction catalogs, surfacing anomalies, outliers, and early signals that deserve deeper human analysis. Reducing the “information-hunt” burden lets Zynergy’s professionals spend more time on judgment and less on search.

2. Scenario Generation & Stress Testing

Large-language-model simulators create thousands of “what-if” macro and micro environments in minutes, quantifying potential upside and downside before capital is deployed. Outputs could potentially flow directly into Zynergy’s decision journal, ensuring every assumption, sensitivity, and risk flag is fully documented.

3. Continuous Learning Loop

Each recommendation, accepted, rejected, or deferred, could feed back into the model, sharpening its sense of which signals matter most. Over time the agents can become better at separating transient noise from persistent trends, boosting both speed and accuracy.

4. Fine-Wine Acquisition Inside the Same Framework

Fine wine straddles luxury passion assets and data-rich commodities. By folding procurement into Zynergy’s core decision-support stack, the firm can consider:

- Monitors global auctions (e.g., Sotheby's, Christie's, Acker Merrall & Condit) for lots that meet vintage, region, and pricing criteria.

- Verifying authenticity with image-forensics models that compare labels, capsules, and glass markings to trusted reference libraries.

- Executing guard-railed auto-bids and reconciles wins directly into portfolio software, ensuring seamless settlement and auditability.

A unified architecture could potentially mean every position in Zynergy’s investment portfolio, including fine-wine allocations, shares the same or similar governance, risk controls, and performance analytics, eliminating silos and accelerating time-to-conviction.

Guardrails That Build Trust

As Zynergy integrates AI more deeply into its investment strategies and decision-making processes, it’s equally committed to building a framework of trust, accountability, and compliance. These aren’t just technical considerations—they're strategic imperatives. The guardrails Zynergy is considering are designed to ensure that its AI agents operate within clear ethical boundaries, reinforce human judgment, and align with evolving regulatory standards. Here’s how Zynergy is developing a responsible AI strategy that fosters long-term trust with stakeholders and partners.

- Transparent Oversight – Every AI agent logs its chain of reasoning and confidence score, keeping outputs auditable and override-ready.

- Data Security – Sensitive materials reside in a segregated, role-based data store; no proprietary information flows to public endpoints.

- Human-in-the-Loop – Zynergy’s professionals retain final authority; agents amplify judgment rather than replace it.

- Regulatory Alignment – Plain-language disclosures and periodic third-party validations help Zynergy avoid “AI-washing” as rules tighten.

What It Means for Investors, Partners, and Advisors

- Sharper Insights – Faster pattern recognition across markets, vintages, and macro shifts.

- Disciplined Risk Control – Stress-testing at scale before capital is deployed.

- Operational Efficiency – Automated triage and procurement free Zynergy’s experts for higher-order thinking.

Agentic AI is now a catalyst for measurable, real-world performance. Zynergy aims to harness decision-support agents across both mainstream and niche strategies to deliver the next generation of investment precision.

Curious about our AI-enhanced investment process? We welcome the conversation.

Article Resources

- Gartner — Top Strategic Technology Trends for 2025

- Deloitte — The Financial-Services Generative AI Dossier (2025)

- BaFin — Insider-Trading Surveillance Overview

- Bain & Company — M&A Report 2025: Trends & Outlook

- Morningstar — Best Robo-Advisors of 2025

- PR Newswire — “Wine E-Commerce Market to Grow by USD 15.18 Billion (2024-2028)”

- Ivan Kunyankin (Devexperts) on LinkedIn

- Alexander Harmsen (Portfolio Pilot) on LinkedIn

- Jacob Bank (Relay.app) on LinkedIn

- CTO Magazine — “AI in Banking: J.P. Morgan Leads the AI Sphere”

- GlobeNewswire — “AI Agents in Financial Services: A $4.5 Billion Industry Opportunity by 2030” (May 2025)