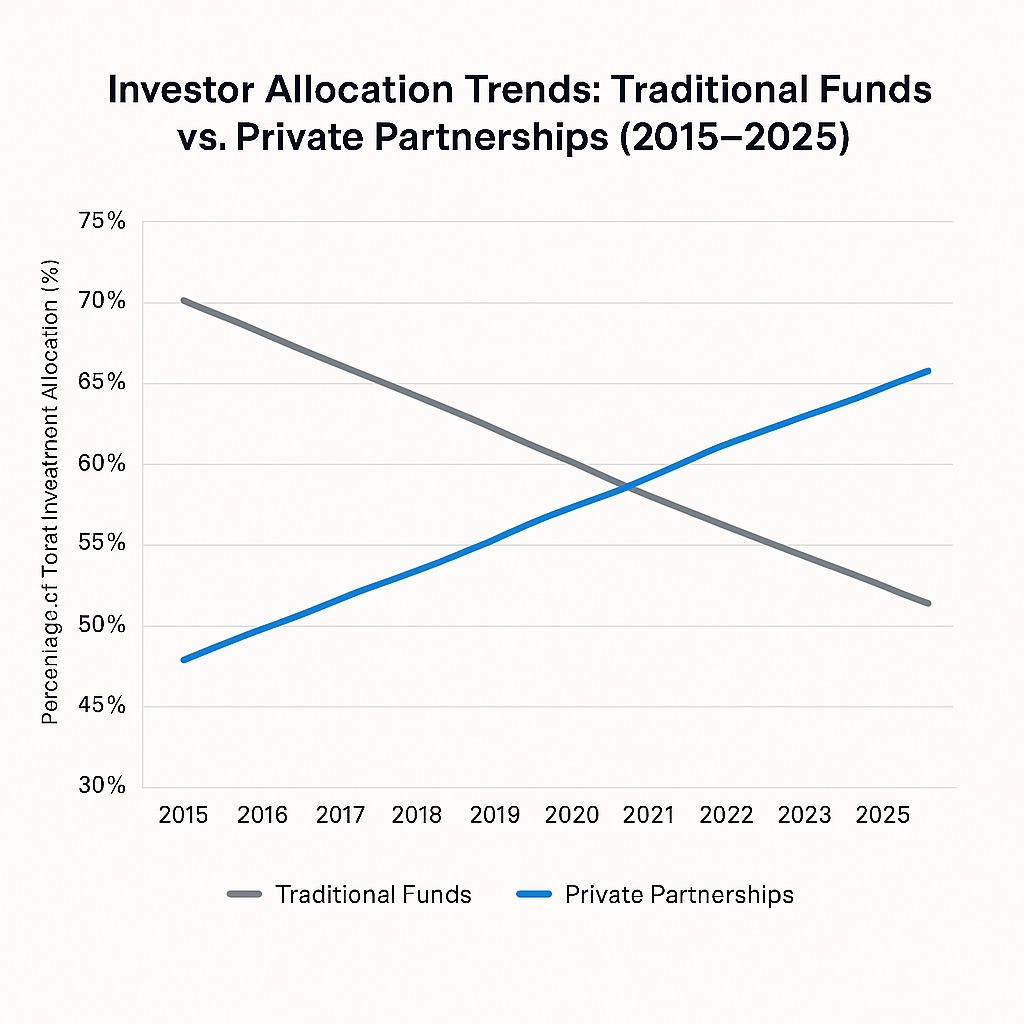

In an investment environment where volatility, overexposure, and institutional constraints threaten returns, a growing cohort of visionary investors is gravitating away from traditional vehicles like mutual funds and ETFs. Instead, they are embracing

private partnerships—a dynamic, agile, and increasingly preferred model that enables both outsized returns and meaningful influence.

This evolution is more than a trend. It reflects a deeper, strategic realignment by

high-net-worth (HNW) and

ultra-high-net-worth (UHNW) individuals who seek performance, personalization, and purpose in their investment portfolios.

The Strategic Shift: From Mass to Tailored Capital Deployment

“Visionary capital is not passive—it’s predictive. It goes where value is about to be created.” – Zynergy Insights

According to a 2023

Harvard Business Review study, 71% of institutional investors believe the traditional fund structure is “too rigid” to capture emerging, high-alpha opportunities in AI, climate tech, and private markets.

Private partnerships, in contrast, offer

tailored deal access, hands-on involvement, and asymmetric upside that institutional frameworks often cannot. They provide a vehicle for strategic capital to engage at earlier stages, participate in operational decisions, and benefit from compounding expertise and influence.

Private Partnerships Deliver What Traditional Funds Can’t

Unlike traditional funds governed by regulatory constraints and mass-market mandates, private partnerships provide:

- Direct Alignment of Interests: Partners invest alongside each other—typically as general or limited partners—ensuring that everyone’s “skin is in the game.”

- Unconstrained Capital Allocation: They can swiftly deploy capital into undervalued private companies, hard assets, and breakthrough innovations without being hampered by public market cycles or quarterly earnings pressure.

- Relationship-Based Deal Flow: A 2024 McKinsey & Company report found that private investors in partnerships gain access to 2.7x more proprietary deal flow compared to fund investors.

- Tax Efficiency and Structure Control: With flexible entity structures (LLCs, LPs, SPVs), private partnerships enable investors to design for long-term tax optimization.

Who Are the Visionary Investors Leading This Movement?

“Wealth follows insight. The most successful investors aren’t waiting for value—they’re shaping it.” – Zynergy Strategy Team

Visionary investors are typically:

- Entrepreneurs and operators reinvesting into high-growth ventures.

- Family offices seeking active investment alternatives.

- Next-gen UHNW leaders who demand transparency and innovation.

A

Bloomberg Wealth report (2024) confirms that 63% of UHNW millennials and Gen X leaders prioritize direct investment opportunities and partnerships over traditional fund vehicles.

Case Study: AI and Innovation-Focused Partnerships

Rather than spreading capital across passive AI ETFs, visionary investors are backing

focused, interdisciplinary private partnerships that combine capital with operational talent to scale niche companies and create exponential value.

MIT Sloan research (2023) noted that private partnerships in AI and deep tech outperform passive index strategies by over 300 basis points annually when investor involvement includes strategic support.

Built for Agility, Driven by Impact

Today’s most successful private partnerships are characterized by their ability to adapt quickly to market shifts and technological change—something traditional funds are often too large or regulated to do effectively. Agile structures, paired with high-caliber leadership and curated networks, empower these partnerships to drive real impact while maximizing returns.

This model is especially powerful in emerging sectors like AI, decentralized infrastructure, digital health, and next-gen consumer platforms—where early entry and operational involvement create meaningful value before the public markets ever take notice.

Private partnerships operate with purpose and precision, and they increasingly serve as engines of economic and cultural transformation, not just financial gain.

Conclusion: The Future Belongs to the Visionary Few

Private partnerships aren’t for everyone—and that’s the point. They’re built for those who see around corners, who want capital to do more than grow: it must influence and shape the future.

For visionary investors ready to think differently,

now is the time to invest with those building tomorrow.

Join Us

Join a network of bold investors shaping the next wave of innovation and wealth.