Why Visionary Investors Are Choosing Private Partnerships Over Traditional Funds

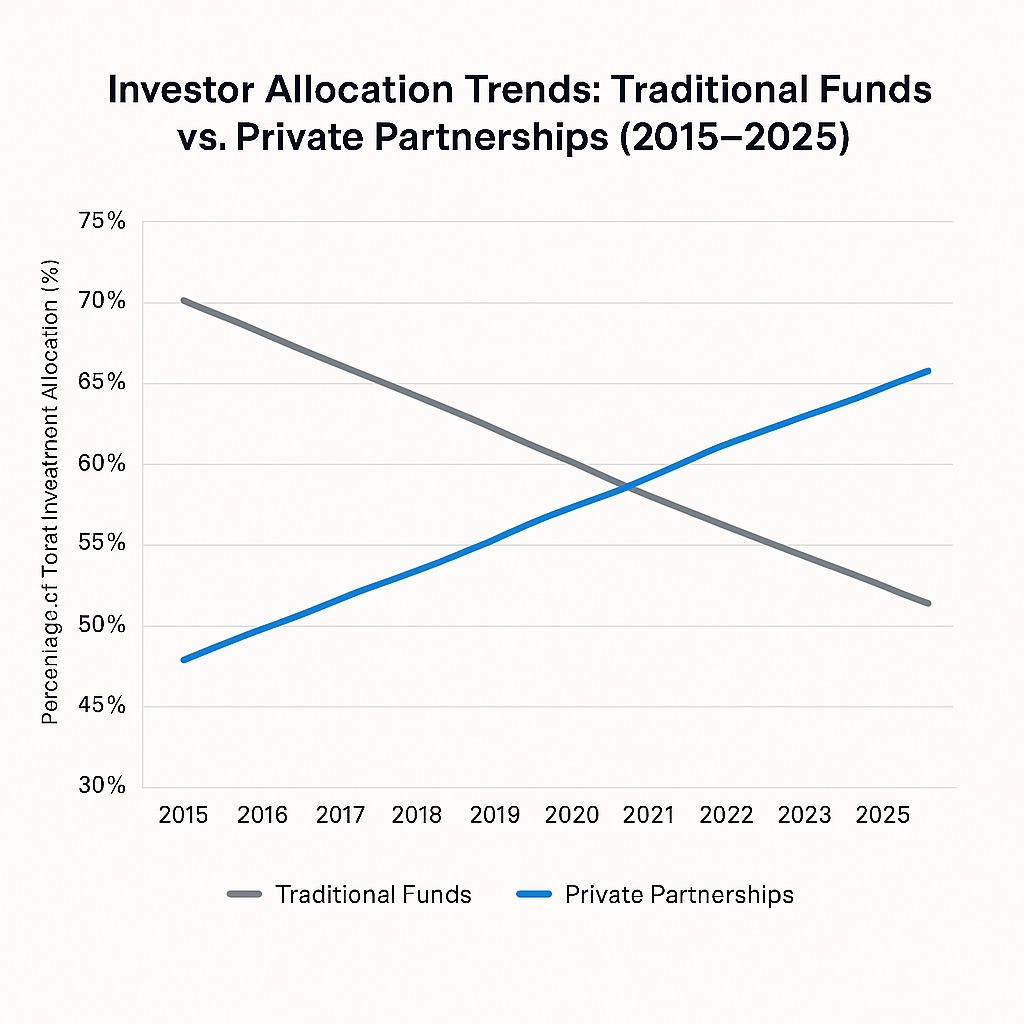

This evolution is more than a trend. It reflects a deeper, strategic realignment by high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals who seek performance, personalization, and purpose in their investment portfolios.

The Strategic Shift: From Mass to Tailored Capital Deployment

Visionary capital is not passive—it’s predictive. It goes where value is about to be created.

According to a 2023 Harvard Business Review study, 71% of institutional investors believe the traditional fund structure is “too rigid” to capture emerging, high-alpha opportunities in AI, climate tech, and private markets.

Private partnerships, in contrast, offer tailored deal access, hands-on involvement, and asymmetric upside that institutional frameworks often cannot. They provide a vehicle for strategic capital to engage at earlier stages, participate in operational decisions, and benefit from compounding expertise and influence.

Private Partnerships Deliver What Traditional Funds Can’t

Unlike traditional funds governed by regulatory constraints and mass-market mandates, private partnerships provide:- Direct Alignment of Interests: Partners invest alongside each other—typically as general or limited partners—ensuring that everyone’s “skin is in the game.”

- Unconstrained Capital Allocation: They can swiftly deploy capital into undervalued private companies, hard assets, and breakthrough innovations without being hampered by public market cycles or quarterly earnings pressure.

- Relationship-Based Deal Flow: A 2024 McKinsey & Company report found that private investors in partnerships gain access to 2.7x more proprietary deal flow compared to fund investors.

- Tax Efficiency and Structure Control: With flexible entity structures (LLCs, LPs, SPVs), private partnerships enable investors to design for long-term tax optimization.

Who Are the Visionary Investors Leading This Movement?

“Wealth follows insight. The most successful investors aren’t waiting for value—they’re shaping it.” – Zynergy Strategy TeamVisionary investors are typically:

- Entrepreneurs and operators reinvesting into high-growth ventures.

- Family offices seeking active investment alternatives.

- Next-gen UHNW leaders who demand transparency and innovation.

Case Study: AI and Innovation-Focused Partnerships

Rather than spreading capital across passive AI ETFs, visionary investors are backing focused, interdisciplinary private partnerships that combine capital with operational talent to scale niche companies and create exponential value. MIT Sloan research (2023) noted that private partnerships in AI and deep tech outperform passive index strategies by over 300 basis points annually when investor involvement includes strategic support.Built for Agility, Driven by Impact

Today’s most successful private partnerships are characterized by their ability to adapt quickly to market shifts and technological change—something traditional funds are often too large or regulated to do effectively. Agile structures, paired with high-caliber leadership and curated networks, empower these partnerships to drive real impact while maximizing returns.This model is especially powerful in emerging sectors like AI, decentralized infrastructure, digital health, and next-gen consumer platforms—where early entry and operational involvement create meaningful value before the public markets ever take notice.

Private partnerships operate with purpose and precision, and they increasingly serve as engines of economic and cultural transformation, not just financial gain.

Conclusion: The Future Belongs to the Visionary Few

Private partnerships aren’t for everyone—and that’s the point. They’re built for those who see around corners, who want capital to do more than grow: it must influence and shape the future.

For visionary investors ready to think differently, now is the time to invest with those building tomorrow.

Join Us

Join a network of bold investors shaping the next wave of innovation and wealth.

Article Resources

Editorial Team

Get Zynergy's Ideas & Insights

Zynergy Investments, LP (referred to as "Zynergy") is a private investment partnership. This commentary is provided for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. The content herein discusses broad market, industry, or sector trends, as well as general economic, market, or political conditions. It has not been provided in a fiduciary capacity under ERISA and should not be construed as research, investment advice, or any specific investment recommendation.

The views expressed in this commentary are the personal views of the authors and do not necessarily reflect the views of Zynergy. These views are current as of the date of publication and are subject to change without notice. Neither the authors nor Zynergy assumes any obligation to update or revise any statements to reflect new information or future events.

Zynergy and individuals or entities affiliated with it may hold positions in or conduct transactions involving securities of companies mentioned or indirectly referenced in this commentary. Zynergy may also offer related investment strategies to third parties for compensation within asset classes mentioned or discussed herein.

Investment ideas and concepts mentioned may not be suitable for all investors depending on individual investment objectives, risk tolerance, or financial circumstances. Margin requirements, transaction costs, commissions, and tax implications should be carefully reviewed with the guidance of qualified investment and tax professionals.

All information contained in this commentary is believed to be accurate and obtained from public sources deemed reliable as of the date of issuance. However, no warranty, express or implied, is provided regarding the completeness or accuracy of such information. Past performance is not a guarantee of, and is not necessarily indicative of, future results.